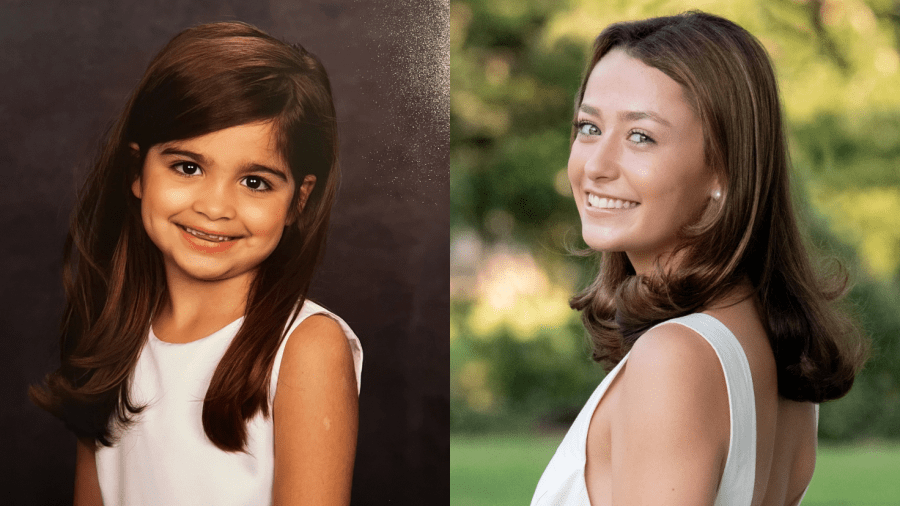

Live Business Update: Rachel Reeves Calls Economy Figures ‘Disappointing’ as More Lenders Enter Sub-4% Mortgage Battle

Economic Outlook and Inflation Predictions

Economic analysts in the United Kingdom are anticipating that the inflation rate will remain stable for June, with expectations of a rate around 3.4 per cent, as suggested by Barclays analysts. This stability is largely attributed to the continuous rise in food prices. The official data from the Office for National Statistics (ONS) is set to be released on Wednesday. However, it has already been reported that the UK economy experienced a contraction of 0.1 per cent in May.

The Ongoing Debate Over Cash ISAs

Simultaneously, discussions surrounding the future of cash Individual Savings Accounts (ISAs) are intensifying. In her upcoming speech at the Mansion House, Shadow Chancellor Rachel Reeves is expected to unveil her plans. The Building Societies Association has cautioned against eliminating the current £20,000 allowance, arguing that such a move would be a significant misstep.

Stock Market Performance

The stock markets have recently seen a surge, with both the Nasdaq in the United States and the FTSE 100 in the UK reaching unprecedented heights. This upward trend appears to be occurring despite ongoing uncertainties over tariff rates stemming from former President Donald Trump’s frequent changes in policy.

Key Financial Highlights

- UK Economy: The UK economy shrank by 0.1 per cent in May, marking a second consecutive month of contraction.

- AstraZeneca Concerns: There are warnings from Labour regarding AstraZeneca’s potential exit from London, which would represent a substantial loss for the FTSE 100.

- Bitcoin Surge: Bitcoin has experienced a remarkable 6 per cent increase, reaching a new all-time high, briefly surpassing $118,000 before settling around $117,500.

GDP Figures and Economic Challenges

Chancellor Rachel Reeves responded to the disappointing GDP figures, stating, “Getting more money in people’s pockets is my number one mission. While today’s figures are disappointing, I am determined to kickstart economic growth and deliver on that promise.” She highlighted various initiatives, including the extension of the £3 bus fare cap and the funding of Free School Meals for over half a million additional children, as part of her government’s approach to stimulating economic activity.

Factors Contributing to Economic Decline

According to the ONS, the decline in May’s GDP can be attributed to reduced production and construction activity. ONS director of economic statistics, Liz McKeown, noted that the decrease was influenced by sectors such as oil and gas extraction, car manufacturing, and the unpredictable pharmaceutical industry. While there was growth in the services sector, particularly in legal services and computer programming, this was offset by a significant downturn in retail sales.

Outlook for the FTSE 100

The FTSE 100 index has remained relatively stable for much of the week, but a surge in the last couple of days saw it close 1.2 per cent higher. Overall, it is up nearly 1.8 per cent for the week, putting it in a strong position to potentially finish positively, barring any unexpected negative news. The index is nearing the 9,000 milestone, a significant psychological barrier for investors.

The Potential Loss of AstraZeneca

Former Chancellor Lord Norman Lamont has raised alarms regarding AstraZeneca’s contemplation of relocating its listing to the United States. He emphasised that losing AstraZeneca, the largest publicly listed firm on the FTSE 100, would be a considerable blow, particularly at a time when the government is striving to stimulate economic growth and boost private investment. Lamont has called for a supportive policy for the life sciences sector to ensure that such crucial companies remain in the UK.

The Controversy Over Wealth Tax

Experts have cautioned that any attempts by Rachel Reeves to address the UK’s public finance shortfalls through a wealth tax could be misguided. With pressure mounting on the government to find approximately £30 billion in savings, experts argue that the historical lack of success in implementing wealth taxes in other countries suggests that the approach may be ineffective. A leading tax lawyer warned that introducing a wealth tax could adversely affect the UK’s overall tax revenue.

Conclusion

As the UK navigates through these economic challenges, including stagnant inflation, shrinking GDP, and potential corporate relocations, the government’s policy decisions will be crucial in determining the future economic landscape. The upcoming announcements by Chancellor Reeves and the ONS data release will be pivotal in shaping both public sentiment and investor confidence.